On the power reserves market and the cost of different energy sources

April 4, 2024 | 12:02 am

My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2024/04/04/585509/on-the-power-reserves-market-and-the-cost-of-different-energy-sources/

The Independent Electricity Market Operator of the Philippines (IEMOP) held a media briefing last week on March 28. Among the topics discussed was the Philippines reserves market that began operation on Jan. 26, 2024.

RISE IN RESERVES AND STABLE ELECTRICITY

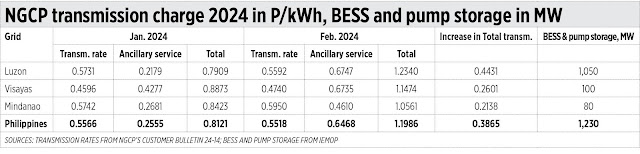

The IEMOP showed data that the reserves of the National Grid Corp. of the Philippines (NGCP) have improved significantly starting February. In the Luzon grid for instance, the contingency reserves have increased from 31% in February 2023 to 100% in February 2024. IEMOP added that “For increased reliability in power grid operations, total scheduled capacity should meet the required level of reserves (i.e., 100%).”

These high contingency reserves mean the likelihood of a blackout is almost zero as any big power plant having an unscheduled shutdown or prolonged maintenance shutdown can be covered by the high level of ancillary services (AS). In my previous article, “10 lessons from the PHL Nuclear Trade Mission to Canada” (March 21), I lambasted the huge increase in the AS rate, meaning the higher transmission charge in our monthly electricity bill which can contribute to higher overall inflation. Now I understand that the pain of a higher transmission charge is less than the gain of a low chance of any blackout. After all, the most expensive electricity is no electricity.

Also covered in the IEMOP media briefing was the power generation mix nationwide. Coal, the most publicly demonized energy source, remains the main savior, the reason why the Philippines does not suffer from daily “Earth Hours” (the celebrate darkness campaign). Meanwhile, the publicly beloved wind/solar power can contribute a measly 3-5% of the total power generation in the country. This is technically insignificant and if relied on, will ensure that “Earth Hours” are guaranteed to happen every single day in the country (see Table 1).

Thank you, NGCP, for finally doing what you should have done many years ago — ensuring adequate reserves and sparing the country from horrible frequent yellow-red alerts yearly. Thank you too, coal generated power plants, for enduring the irrational attacks of the climate activists and giving us lights and air conditioning every day and night.

But there is a question mark on the action of the Energy Regulatory Commission (ERC) which suspended the price determination methodology of the reserves market. No price stability means no supply stability for reserves and hence we might go back to the ugly situation of frequent yellow-red alerts.

That is a topic for another column.

PEPIF 2024 IN ILOILO CITY

The Philippine Electric Power Industry Forum (PEPIF) 2024, organized by IEMOP, will be held tomorrow, April 5, at the Iloilo Convention Center (ICON) in Iloilo City. The conference theme is “Powering a Sustainable and Secure Energy Future for the Country.”

Among the speakers will be Iloilo City Mayor Jerry P. Trenas, top officials of the Department of Energy led by Secretary Raphael Perpetuo M. Lotilla, ERC Chairperson and CEO Monalisa C. Dimalanta, National Electrification Administration Administrator Antonio Almeda, National Transmission Corp. President and CEO Fortunato Leynes, NGCP Head of Transmission Planning Redi Remoroza, Aboitiz Renewables, Inc. President and COO James Villaroman, MORE Electric President and CEO Roel Castro, Napocor President and CEO Fernando Roxas, ACEN Corp. COO Miguel de Jesus, and IEMOP President and CEO Richard Nethercroft.

They will discuss the Philippines’ energy transition plan via more renewables. Not in the program is a discussion on nuclear power development as part of energy security for the Philippines. Luckily, I saw a new paper on nuclear energy price competitiveness.

PAPER ON LCOE PHILIPPINES ENERGY

The paper, “Comparative Analysis of the Levelized Cost of Electricity of Selected Power Generation Technologies in the 2020-2040 Philippine Energy Plan” (March 2024, 49 pages) was written by Dr. Arturo E. Romero, Jr., a geophysicist and new Department of Science and Technology Balik Scientist who will be based at the Philippines Nuclear Research Institute (PNRI).

The focus of his study is the computation of the levelized cost of electricity (LCOE) of various energy sources. LCOE is defined by the author as “the sum of all discounted cost of the facility normalized by the total power produced over its technical life. It focuses on plant level financials without considering system-wide interplay of power supply and demand, dispatchability and crowding of the grid systems and the effects on electricity pricing.”

The author produced several charts and figures on the computed LCOE of Philippines’ existing and potential energy sources. From the math model and data he gathered, the results show that the cheapest LCOE is to rehabilitate and refurbish the Bataan Nuclear Power Plant (BNPP) which will have an average LCOE of only $44/megawatt hour (MWh), the second lowest to nuclear long-term operation (LTO) life extension at only $34/MWh.

The next cheapest LCOE comes from a liquefied natural gas (LNG) combined cycle (CC) gas turbine and from solar photovoltaic (PV) at $52/MWh. LNG open cycle (OC) has a high LCOE of $94/MWh if there is no carbon tax included. The most expensive LCOE would be from concentrated solar power (CSP) at $123/MWh (see Table 2).

Thank you, Dr. Romero for producing the numbers. And thank you, PNRI and its Director Dr. Caloy Arcilla, for getting this brilliant mind back to the Philippines.

As an economics researcher and writer, my main concern is how the Philippines can attain high economic growth and sustain this for many years in order to create more jobs and entrepreneurs for Filipinos and Philippines-based businesses. Having expensive electricity and intermittent, unstable and blackout-friendly energy sources are inconsistent with the goal of sustained high growth.

I like this observation made by Lino Bernardo, Head of Energy Transition Projects of Aboitiz Power, among my co-participants at the Philippines Nuclear Trade Mission to Canada last month in Toronto. He said:

“While the first nuclear power plants are expected in the 2030s, other baseload technologies must continue to provide the much-needed power this decade and into the next. Beyond the generation of stable electricity, the country should also look to harness the potential of nuclear energy in the academe, industry, and medicine, through atomic particle research, radioisotopes as industrial tracers, and radiation for diagnosis and therapy procedures, respectively. We need to prepare in terms of policy, regulation, and education to ensure safety and proper waste management in nuclear power generation and further.”

Energy security will help attain overall economic security. People can work productively even when the sun is not shining, and the wind is not blowing. They can walk the streets safely at night under bright lights, travel long distance via trains that run on electricity, and so on.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

------------

See also:

BWorld 692, 10 lessons from the PHL Nuclear Trade Mission to Canada

BWorld 693, On Earth Hour, Lenten travel, and Pinoys in Toronto

BWorld 694, High growth imperative and fiscal consolidation